For anyone managing a healthcare organization, smooth and healthy financial operations are a must. After all, without strong financial management, the whole system can start to unravel. But let’s face it—navigating revenue cycle management challenges isn’t always easy. From claim denials to ever-evolving regulations, the financial side of healthcare can be complicated. That’s why it’s so important to have strategies in place that keep things running efficiently. Let’s talk about how to overcome common financial hurdles in healthcare and keep your revenue cycle on track.

What Makes Revenue Cycle Management So Tricky

![]()

Credit: pharmbills.com

The revenue cycle management challenges aren’t just about collecting payments. RCM covers a lot, from patient registration and insurance verification to coding, claims submission, follow-ups, and payment posting. Each step has its own risks.

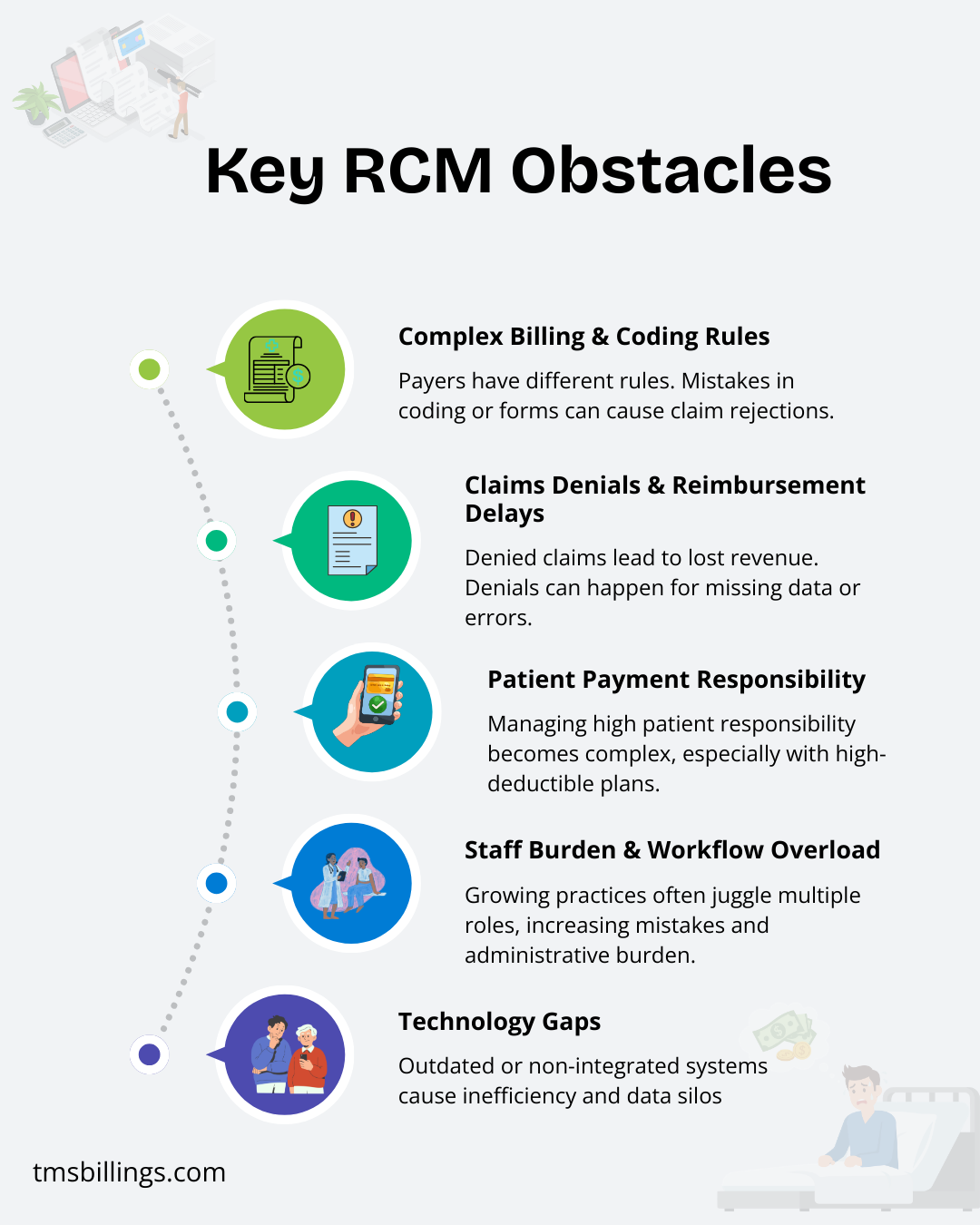

Here are some of the common roadblocks many practices hit:

- Healthcare organizations struggle to keep up with constantly changing payer rules and requirements.

- Claim rejections due to incorrect codes or missing information lead to delays.

- Billing and reimbursement issues occur when systems aren’t streamlined.

- Rising reimbursement rates are often a challenge to deal with, impacting cash flow.

- Charge capture errors can lead to lost revenue.

When these issues arise, it slows down everything. Your cash flow becomes unpredictable, and instead of focusing on patient care, you’re spending more time on paperwork.

Top Revenue Cycle Challenges & How to Fix Them

Let’s break down each of these challenges in revenue cycle management for hospitals and practices and how to handle them.

Challenge 1: Complex Billing and Coding Rules

Every payer, Medicare, private insurers, and Medicaid, has different rules. The healthcare revenue generated depends on the accuracy of coding and claims submission. A minor mistake, like a wrong code or a missing form, can result in claim rejections.

How to fix it

- Use skilled, certified coders who are familiar with the latest codes, payer rules, and regulations.

- Implement a revenue cycle management improvement process that ensures claims are submitted with complete and accurate data.

- Use automated systems that check for coding errors before submission, reducing the chances of claim rejections and speeding up the process.

By ensuring claims are processed right the first time, you’ll improve your revenue cycle hospital operations and ensure timely payments. If you’re interested in understanding how different billing methods can play a role in this process, check out our guide on types of billing. It’ll give you a clearer picture of how to handle the complexities and streamline your workflow.

Challenge 2: Claims Denials & Reimbursement Delays

Credit: prognocis.com

Lost revenue often stems from denied claims. Healthcare revenue can take a significant hit when claims are not processed correctly the first time. Denials can happen for various reasons — from errors in patient registration to missing information in claims submission.

How to fix it

- Track claim rejections closely to identify common patterns (e.g., a specific payer’s error).

- Streamline your revenue cycle management healthcare process with clear protocols for claims review and follow-up.

- Have a dedicated team or outsourced billing services for denial management that can quickly resolve issues and resubmit claims.

This minimizes the delays in your revenue cycle, meaning faster payments and fewer denials.

Challenge 3: Patient Payment Responsibility

With more patients shouldering a higher portion of the costs due to high-deductible plans, managing patient payments becomes trickier. Billing and reimbursement complications arise when patient responsibility is unclear or not collected upfront.

How to fix it

- Verify insurance coverage before appointments to know exactly what the patient owes and ensure accurate charge capture.

- Offer clear communication to patients about their medical bills and payment options.

- Implement easy online payment systems and give patients clear, manageable options for paying their balance.

Helping patients understand what they owe and making payment easy improves both your collections and patient satisfaction.

Challenge 4: Staff Burden & Workflow Overload

Credit: cbsmedicalbilling.com

As a healthcare practice grows, staff often juggle multiple roles. Without a strong workflow for the revenue cycle management, mistakes become more frequent, and the process slows down. This increases the administrative burden on your team, taking them away from patient care.

How to fix it

- Standardize your workflows for billing and reimbursement, patient registration, and claim follow-up to ensure smooth operations.

- Automate patient care data collection and submission processes to reduce manual input and errors.

- Outsource parts of your RCM process if necessary. Partnering with a professional RCM service can free up your staff to focus on patient care.

These strategies reduce burnout, boost staff morale, and keep your practice running efficiently.

Challenge 5: Technology Gaps

Outdated systems or a lack of integration between patient records, billing systems, and claim tracking software can create inefficiencies in your revenue cycle management. Data silos make it harder to track claims, follow up on payments, and get a clear view of your revenue performance.

How to fix it

- Implement integrated software solutions that allow your EHR, billing system, and insurance verification tools to work together.

- Regularly update your technology to ensure you’re using the latest systems for tracking claims, processing payments, and monitoring revenue performance.

- Consider outsourcing to a specialized RCM provider who uses advanced technology to streamline your entire process.

By embracing the right technology, you can eliminate inefficiencies, reduce errors, and improve the healthcare revenue cycle.

The Real Cost of RCM Problems

When RCM doesn’t work properly, it can hurt more than just your finances. Here’s what can happen:

- Lost revenue: Missed claims, denials, and delayed payments all impact your practice’s bottom line.

- Increased patient care delays: More time spent on administrative work means less time with patients.

- Claim rejections: Can lead to higher administrative costs, as your team spends more time resubmitting claims.

- Compliance issues: Poorly handled RCM can open you up to legal or regulatory risks, leading to audits and fines.

By managing your RCM more effectively, you can avoid these issues and focus on improving your practice’s efficiency.

Smart Ways to Overcome RCM Challenges

Here’s a summary of smart strategies many practices use to tackle challenges in revenue cycle management:

- Automate your processes: Implement software for billing, eligibility checks, claim submission, and payment posting.

- Train your team: Make sure everyone understands coding, insurance rules, and the importance of accurate charge capture.

- Use clear, consistent workflows for patient data collection, insurance verification, billing, and follow-up.

- Outsource RCM when necessary — it’s a great way to improve accuracy, reduce the administrative burden, and increase revenue.

- Track and analyze key performance indicators (KPIs) like days in accounts receivable, denials, and cash flow. This helps you identify problem areas early.

Ending Remarks

By addressing revenue cycle management challenges for hospitals or smaller practices, implementing better workflows, using the right technology, and potentially outsourcing, you’ll improve both your financial performance and the patient care experience. According to the Healthcare Financial Management Association (HFMA), staying up to date with industry best practices and adopting streamlined processes is key to overcoming common RCM challenges.

Frequently Asked Questions

Here’s what you need to know about the revenue management cycle.

What is Revenue Cycle Management (RCM)?

RCM is the management of financial transactions between providers, patients, and insurers, from registration to payment.

What are the main challenges in revenue cycle management?

Challenges include claim rejections, high patient responsibility, outdated tech, and complex billing.

How can I improve revenue cycle management at my practice?

Optimize processes, automate workflows, stay current with rules, and communicate clearly with patients.

How do billing and reimbursement issues impact revenue?

Errors, delays, and rejections slow payments and create cash flow problems.

What are the benefits of outsourcing revenue cycle management?

Outsourcing reduces admin, improves accuracy, speeds payments, and lets staff focus on care.